Welcome to FinGlobe Advisors !!

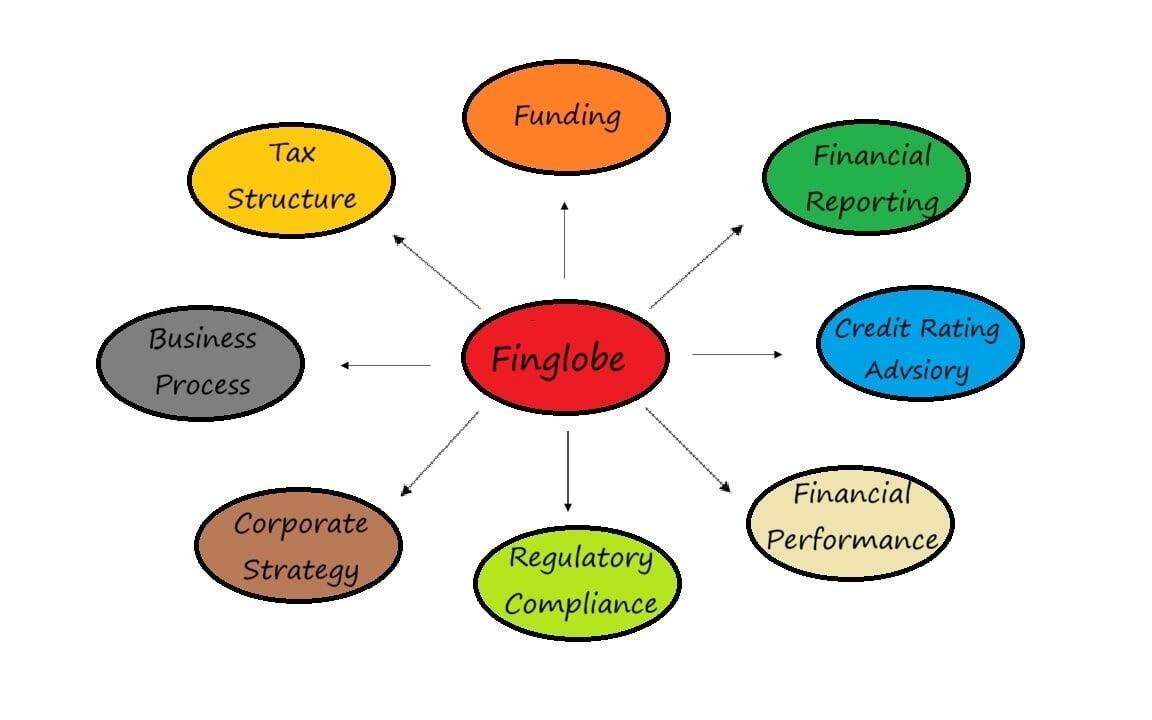

FinGlobe Advisors LLP is a Mumbai-based, dynamic and growth-oriented financial advisory firm committed to empowering small and medium enterprises (SMEs) and mid-sized companies through strategic financial solutions. With a multidisciplinary approach and deep industry experience, FinGlobe offers an integrated suite of services spanning strategic finance, compliance, operational controls, and capital advisory. The firm serves as a trusted partner in helping businesses optimize performance, enhance financial visibility, maintain statutory compliance, and access capital for growth.

Virtual / Fractional CFO Services:

- Strategic financial leadership for businesses.

- Board-level reporting and financial strategy execution.

- Financial control and policy implementation.

Credit Rating Advisory:

- Credit score enhancement strategies.

- Board-level reporting and financial strategy execution.

- Support during rating reviews and upgrades.

Financial Reporting & MIS Analysis:

- Monthly and quarterly financial reporting.

- Management dashboards and KPI tracking.

- Profitability and trend analysis.

Cash Flow Management:

- Short-term and long-term cash flow planning.

- Fund flow and liquidity management.

- Working capital optimization.

Investment & Fundraising Assistance:

- Fundraising from banks, NBFCs, etc.,

- Debt structuring and CMA data preparation.

- Liaising with financial institutions.

Forecasting, Budgeting & Cost Control:

- Creation of dynamic forecasts and business budgets.

- Cost reduction strategies and monitoring.

- Real-time variance analysis and financial planning.

Tax Compliance Management:

- Direct and indirect tax return filing and compliance.

- Advance tax, TDS, and assessments.

- Representation for tax-related matters.

Internal Audit & Risk Control:

- Process audit and internal control evaluation.

- Recommendations for efficiency and compliance.

- Monitoring and reporting risk exposures.

WHY CHOOSE FINGLOBE ADVISORS LLP?

- Expertise: Our team comprises seasoned professionals with extensive knowledge of the SME sector and financial markets.

- Customized Solutions: We recognize that every business is unique, offering tailored services to meet specific needs and objectives.

- Proven Success: A strong track record of successful debt advisory engagements highlights our capability in helping SMEs achieve financial stability and growth.

- Comprehensive Support: From initial credit assessment to long-term financial planning, we provide end-to-end support to ensure client success.

- Client-Centric Approach: We prioritize the needs of our clients, offering personalized attention and strategic advice to help them thrive in a competitive marketplace.

10+

Years of Experience

250+

Clients PAN India

95%

Success Ratio

Industries We Served !!

1. PVC and Automobile Mould Manufacturer

2. Design and Build Turnkey Project - PEB/Civil/MEP

3. Fast Moving Consumable Goods (FMCG)

4. Steel Manufacturer

5. Internet Service Provider (ISP)

6. Transpotation and Logistics

7. Manufacturer of Gems & Jewellers

8. Tourism

9. Timber and Plywood

10. Computer Hardware and Software